The Debt Roll Up process (often referred to as debt snowball) is simple to understand and implement. This method to pay down credit card debt requires commitment and discipline. The approach is straight forward. You simply pay more than the required minimum payment on one credit card until it is paid off.

Once you knock down the first account, you use the same amount of money you were using to pay the first card and apply ALL of it in addition to the minimum you are paying on card two – until it is paid off.

You then take the same amount you were once paying to card one and two and combine ALL of that money with the payment you were already making to card three until it is paid off.

You repeat these same steps until all credit cards are paid down to zero. In other words, you are rolling up you money to pay off each successive balance, or using additionally money to gain momentum on paying off the next debt until your last remaining debt is being paid off with the largest amount of money, like a debt snowball rolling down hill grows in size.

Many people have success with this method. In fact, after the credit cards are paid off, some will go on to apply the money that was being used to pay credit card debt and use it to accelerate the payoff on vehicles and mortgages!

The debt roll up strategy is used by someone with the monthly cash flow that supports an ability to pay roughly 20% more than the required minimum payment on the credit card that receives the first “roll up”, or “debt snowball” treatment.

Successful use of this strategy is not just about having the money in your monthly budget to support the debt payoff effort. It can often include making sacrifices.

How to pay off credit card debt quickly with debt roll up.

- Changes in spending habits

- How you think about money

- Tracking daily spending

- Curbing any tendencies to spend impulsively

- Delaying gratification.

The use of a credit card, or any form of debt for that matter, can be looked at as “pulled forward demand”. You are buying something that you either cannot, or choose not to, pay for in full. Delaying purchases that can be put off or eliminated entirely will help you plan around the debt roll up strategy.

The key to aggressively paying off credit card debt using money from your available budget is not to create any new debt!

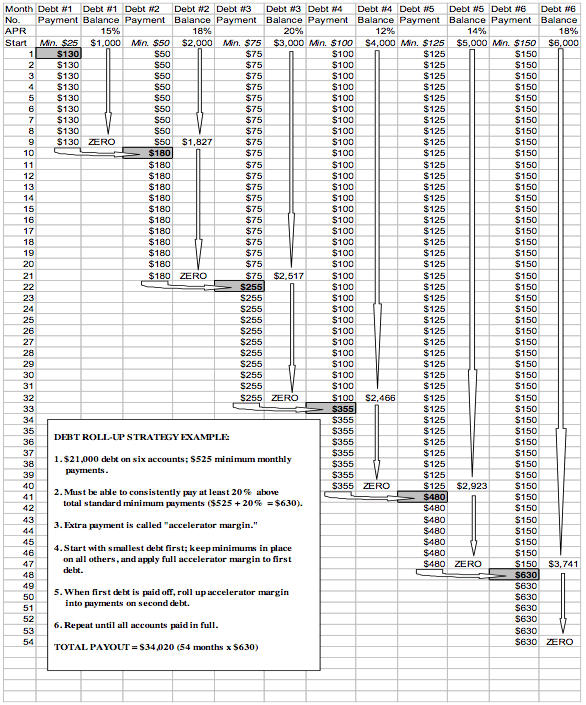

Here is a basic example graph of what a debt roll up strategy would look like with 6 accounts:

Image may be NSFW.

Clik here to view.

The CRN debt relief program is designed to offer debt solutions that involve one on one support, guidance and service. It is rare for someone implementing a debt roll up strategy to need to pay anyone for support. If you are working with a debt roll up strategy, and have a unique situation where CRN membership would be of value, call us and we can talk about it.

Otherwise: If your credit card and other debt is a problem, but you have room in your household budget to use the debt roll up method, you may benefit from joining a community that supports this approach. Check out ready for zero and look at some of the fantastic technology tools they have available for free!

Debt Roll Up became more popularized by Dave Ramsey and John Cummuta. Ramsey is likely responsible for the term “debt snowball” becoming the most familiar way debt roll up is described.

If you are a Dave Ramsey fan, have questions or comments about variations of working through a debt roll up process of your own, or simply want to share your successes with other readers, you are welcome to participate in the comments below.

If you are new to the CRN site and would like to get comprehensive information about different options for dealing with problem debt, we recommend starting your review of our free online debt relief program with: Introduction to Debt Relief.

- Suzanne:

20 Oct 2013 Hi Michael, So here's the list...thank you so much for your time and help with this!: GE Cap/Amazon: Limit: 2200 Balance: 2148 APR: 25.99 MP: 70 Payment to pay off in 3 years: 87 Bill Me Later: Limit: 1200 Balance: 1243 APR: 19.99 MP: 37 Payment to pay off in 3 years: 46 CapitalOne: Limit: 2250 Balance: 2250 APR: 18.9 MP: 62 Payment to pay off in 3 years: 83 CapitalOne: Limit: 1200 Balance: 1011 APR: 14.99 MP: 27 Payment to pay off in 3 years: 42 Chase: Limit: 3000 Balance: 875 APR: 14.99 MP: $20 Payment to pay off in 3 years: 31 I closed this account - can't remember exactly when, but it was essentially maxed out at the time - and have been paying it down...they were going to raise the interest rate, so I closed to pay off at 15%. So my plan was to basically pay off Amazon in one shot, add the $70 I've been paying them to the BML payment of approximately $35 (maybe pay a little more than $105 if I can...) to finish that one off in about a year (looks like I'd need to pay around $115 to do that). Then tackle the larger CapitalOne account, which I would have paid down somewhat by then, maybe to around $1800 or so, then I would add the $115 on to the $60 I'd been paying and I could pay that off in another year. By then, the Chase would be pretty low and could be paid off in a few months by adding the $175 to the $20 minimum payment there. That would only leave the better (used-to-be Orchard Bank...) CapitalOne, which I actually plan to keep using during this process for whenever I need to use a CC. So basically I would probably NOT be paying that one down as I go through knocking out the others. Then I could pay that off in 6 months. Still seems to be taking nearly 3 years, which is what it would take if I paid off the Amazon and paid the 3-month payoff amounts on all the others, which would be around $200 a month total. If somewhere in the process I could qualify for a loan with reasonable interest, say around 10-12%, or maybe another card with no-interest balance transfer for a period of time, I could pay other things off and maybe get out of this mess faster. Does my plan make the most sense, in your opinion, or is another approach better in terms of improving my credit/report score (currently 667)? I would still hope it would take under 3 years...sounds like a long time, but obviously much better than 12 or 20... Thank you for your help!!! - Suzanne:

20 Oct 2013 I should have also asked, is it preferable to leave the accounts open as they are being paid off? - Suzanne:

21 Oct 2013 HI Michael, First, a correction in my original comment...should have been "3-year payoff amounts, which would be around $200 a month total." Now...Here's another option...I went to Ready For Zero and applied for a Lending Club loan. Apparently, I qualify for a $5,925 loan at 18.77% APR (which includes the 5% origination fee), with a 3-year term and monthly payment of $205.69. If I accepted that loan and used it to pay off Amazon, BML and the "bad" CapitalOne card, all of which are at higher interest rates than the loan, and which total approximately $5,600, and then used my cash-on-hand to pay off Chase and the "good" CapitalOne, which total approximately $2,100, I would only have the one payment of $205.69 a month. Does this look like a good option to you, and would it help or hurt my credit score? Doing the debt roll up, I estimate my monthly payments combined would be around $220, and I might be finished a couple of months sooner(?). BUT...some of the APRs I currently have are variable, so there's a chance that could change, either for better or worse, while the Lending Club loan is fixed. I was hoping for a better interest rate if I was going to consolidate, but I think this may still be an acceptable trade-off. What do you think? Thank you! - Suzanne:

21 Oct 2013 Or...if I paid off Amazon first, then reapplied for the loan, is there a chance I could get a lower interest rate? - Michael Bovee:

21 Oct 2013 Suzanne - Thanks for all of the details and sharing the thought process you are going through. Here are my thoughts and a couple questions: You are qualifying for the consolidation loan with Lending Club, but not at an optimized interest rate. Without digging into the details one on one, I would suggest that is primarily the result of your credit score. If your score were over 700, you would be in a better tiered loan category, and would likely qualify for a lower interest rate (unless there were other anomalies on your credit report). As a result, the savings and time to payoff the total debt is near a wash. Paying down the debts to improve your credit utilization and debt to income can indeed lead to a higher credit score. It is what I would focus on if I were in your shoes. It could take a couple of months to see the improvement to your score, and with two hard credit inquires (Prosper and Lending Club), I would wait 6 or more months to reapply. You may also find some better options to consolidate using a lower interest card. I like the tool for credit product matching that credit.com has. Some questions: What, if any, federal tax refund do you receive? Is your tax refund (if you get one) earmarked for any other expense (many people use that to pay property tax etc.)? Are there any late pays or other negatives on your credit report? It is best to leave the accounts open. Once you get your credit score where you want it, then selectively choose accounts you no longer want open, and close them. - Suzanne:

22 Oct 2013 Michael, So...would you suggest I start the debt roll up, as I described above, paying off Amazon and moving on the BML? Do those types of accounts carry as much weight on a credit report/score as regular bank cards, such as Capital One? My understanding is that Prosper and Lending Club do a "soft pull" which does not affect credit score...is that not the case? And, I thought Prosper was more lenient on credit score to qualify, yet they turned me down. Do you think it is better to pay the individual accounts (even though the interest rates on some are variable and may go up...) rather than taking the loan at a fixed rate, where I know everything will be paid of within 3 years? - Michael Bovee:

22 Oct 2013 If it were me I would not take out a consolidation loan... yet. I would probably wait 6 or so months and then take out a consolidation loan. Here's why: If I had no 30, 60 day late pays on my credit report (you did not answer that), I would see my credit score being impacted by the fact that several open accounts are at their credit limit (bill me later is over). I would want to use the lump sum I have to either: Pay down debts aggressively using the debt roll up strategy by applying funds to the highest interest debt first (but pay bill me later enough to bring it under the credit limit), and continue that with an eye on applying any tax refund, or other sources of additional cash, to continue that process. Disperse the lump sum amongst open accounts to quickly bring them under 50% credit limit utilization (ideally under 30-ish percent), with the idea that my credit score would improve relatively quickly due to bringing credit utilization in line with credit scoring models. I would then look to consolidate these debts into a better loan than the 18% available now. I may even look for a good intro offer credit card as an alternative to the peer to peer lending option. I would be geared more toward the first option. I would not say traditional credit card accounts are treated differently as a general rule, as much as I would say different scoring models are used for different loan products. And that could introduce a different weighting. Side note, it was announced this morning that Bill Me Later is being investigated by the CFPB for excessive financing charges. Sorry for confusion on hard vs soft pull. Both do soft credit pulls. But I would refrain from any credit apps for 6 months if you do have hard pulls within the prior 6 months. I have seen people turned down by Prosper with better scores than yours. It may have something to do with your current utilization being so high, or even recent credit inquiries. I personally would not be overly concerned about the variable interest rates until you know where you fall in. But I get the value in having a single predictable payment to make rather than several. Putting your debt roll up on auto pilot, as long as your income is steady and dependable, certainly would free up time and head space :) I would be stuck on the 18% plus interest though, and would want to hold out for a better rate in the near future. - Suzanne:

22 Oct 2013 Thank you, Michael! I just paid $1148 off on Amazon and $111 on BML...glad they are being investigated, maybe will deter others from getting suckered in...it sounds so nice, doesn't it? Just bill me later...plus 20%! I held out on paying off Amazon completely until I get a bit more cash in my account...don't want to be zeroed out...and also till I heard your opinion, thinking maybe I should pay half of each of the two largest balances, or something along those lines. I can still pay Amazon off by the end of this billing cycle, after I get another paycheck or two in the bank. Or I could pay half of the larger Capital One, even though the interest rate is significantly lower. I'm thinking I would prefer to just cross something off the list completely. I think I was a day or two late on one Amazon payment last year, I just forgot or lost track of the date, and I made a mistake paying my Care Credit bill (which has since been paid off...) which caused my payment to be late (I had two checking accounts at the time, and I selected the wrong account/routing number combination, so the payment did not go through, and they did not notify me so I didn't know until I went to pay them for the next billing cycle) other than that, no late payments that I can recall. Sorry I didn't answer that before. So BML will be under the "limit" tomorrow - actually, they call it a credit "line" not a "limit" and there was no penalty for going over it. That payment would be my first of about 12 to pay it off. Obviously, the other accounts will not be in that 50% or lower range for a while (unless I request a credit increase...which I likely would not get). I am thinking about ways to get more money coming in (or less going out...) so I can get this done faster. Federal refund will not be more than a few hundred, as I was unemployed for part of this year and will be under the level to pay income tax, so I nixed withholding for the remainder of this year so I have more money to work with right now. My income should be steady now, although pretty low. I can't really commit much more than $200/month to paying all these bills and still put food on the table and gas in the car... I feel like I'm on the right track now, at least. Isn't it amazing what low interest rates people are getting now on their savings, versus what exorbitant interest rates are being charged for loans and credit cards? I may alert some of my family and friends who may have money invested at ridiculously low returns to Prosper and Lending Club as potential investments, instead of CDs at 1% or saving accounts with even lower returns. - Michael Bovee:

22 Oct 2013 It doesn't sound like the Amazon late pay would show on your credit report (you were only a couple days late). If Care Credit ended up showing a 30 day late, the negative potency from that is greatly diminished after 24 months. All things considered, you should be in good shape credit score wise, after you bring your utilization in line with conventional wisdom and scoring models. The current rate environment may help mask an economy still struggling to gain momentum, but it absolutely does hurt savers. A friend of mine is an active investor in Lending Club, and has been for a few years. He focuses on funding the middle tier where he has a bit of risk, with a bit higher return. He has been very happy with his experience. - Suzanne:

22 Oct 2013 Thanks again for your help, Michael! Are you affiliated with Ready for Zero? I saw the link for it up above...they, at least thus far, cannot link the Amazon or BML accounts, so I'm not sure if it's going to work for me...great idea, though. I'll check back in here to let you know how I make out. Thank very much! All the best! - Michael Bovee:

22 Oct 2013 I am a big fan of ready for zero is all. Have been since they were in beta. I know they started an affiliate structure, but I have not looked into it. Great tool, and great management too! Please do check back and post an update as you make progress. - Joyce Hollman:

22 Apr 2016 Just had a really nice conversation with Michael. It's astonishing to me that someone actually calls me back personally, and is so invested in helping me find options. As far as the Debt Rollup, I shared with Michael that, although I have two kids in college and always seem to be scraping together their tuition payments, with none left to lower my debt, I've now come to realize that I need to do just that. In fact, upon looking more carefully at my budget, I realize that there is $200 a month I've been sending to Best Buy to try and pay off my kids' computers before the zero interest promotional period expires. I'm now going to send this to my credit card, since the interest I'm paying them is way more than I will pay to Best Buy. Makes sense, huh? But, until I was prompted to take another look, this never occurred to me. You just get into a way of handling your budget, and think it's the best way, when sometimes there's another way..... - Eddie:

13 May 2016 My name is Edwin Martinez we spoke about two weeks ago and went over some strategies to pay off my credit card debt. I was hoping you could address a couple follow up questions? 1. I have credit cards with citi, chase, capital One and Barclays . So I'm moving ahead in June with letting my cards go past due a few days then calling each credit card company and negotiate to have a lower monthly payment. Do any of these creditors offer opportunity like this? 2. In doing this can it hurt my credit score? If so in what way? Will they close my cards? What are the things that will happen when I take this course of action? FYI the reason I'm doing this, its because I want to do debt snow ball method but as it stands the amount I have left over after all bills and living expenses is just under 200 dollars. 3. Since I bank with Chase should I move the majority of my checking into another bank or just cash it out and hold on to it? I'm worried that Chase would see I have funds to pay off some of my cards that I have with them and would not consider my request. Thanks for your help - Michael Bovee:

14 May 2016 Hi Edwin. All four of those banks will offer their card members reduced monthly payments by lowering your interest rates. Some of them will listen to your hardship scenario and ask additional monthly income and expense questions. If you have about what you mentioned left over after all necessities are paid they tend to make the concessions, but... not always. You do run the risk of being late a week or two - in order to show the need for them to lower the interest rates - and having them say no to any plan and charging you a late fee. If you are credit score sensitive you will not want to allow an account to go 30 days late. That could mean paying the amount you are late, and any other fees, to bring the account current before that happens. How much a 30 day late pay will hurt your credit score will vary from one person to the next. You do run the risk of a creditor closing your account. AMEX is probably the most likely to do that, but I have seen Citibank, Barclay and Chase do the same thing over the years. Closing accounts does not necessarily mean any credit damage. Review this multi part article series I have up about hardship plans to get a feel for what you are looking at doing. https://consumerrecoverynetwork.com/hardship-payment-plans/ https://consumerrecoverynetwork.com/hardship-payment-plan-warning/ I have some videos up on my YouTube channel that cover this too. I generally am only concerned about the bank you have checking and savings with when you are trying to negotiate a settlement for less with them. If it were me, I would not be worried that I bank with Chase if I were working toward the outcome you are. - Lauren:

02 Jun 2016 The spreadsheet example looks like it would work well for me. Is there an existing template that I could use to plug in my information? - Michael Bovee:

02 Jun 2016 I can email you the spread sheet I used for the article if you like? You can input your debts and use the calculations and formulas that way. - Lauren:

02 Jun 2016 That would be fantastic! Thank you for the prompt response. - Tia:

22 Aug 2016 Would you please email me a copy of the spreadsheet you used on this site? I'm in the process of gathering all my information and your tool would really help me! Thank you on advance!! - Michael Bovee:

22 Aug 2016 I sent the excel doc Tia. Let me know what king of progress you make with your debt roll up strategy. - jessah gallardo:

14 Sep 2016 hi. can you please send me the spreadsheet for debt roll up i want to apply it for myself too. thank you. these will really help me a lot. - Michael Bovee:

14 Sep 2016 Check your email. Post an update to this comment string if you find it helpful and begin to use it. - Stephanie Mills:

26 Sep 2016 May I please have a copy of the debt roll-up spreadsheet? Thank you! - Michael Bovee:

26 Sep 2016 Check your email Stephanie. Let me know if you find the spread sheet helpful. - Alaina:

01 Dec 2016 HI Michael, I am not sure if this thread is live anymore, but could I have a copy of your spreadsheet? I have 3 credit cards. One with Old Navy for $6,100 with the highest interest rate at 22%, one with Citi for $4,000 at 18%, and one with Barclay for $1,000 and 0% for the next 13 months. I called Old Navy's company to discuss repayment options because it was becoming hard to make the minimum, but I have never been late. My monthly net income is $2,100. Do you feel the debt roll up is the best strategy for me? - Michael Bovee:

04 Dec 2016 I am going to email you the excel doc after posting this reply, so look for that. I nearly always will encourage someone to try the debt roll up strategy on their own if you have the income to throw even a small amount extra at your debt each month. You typically do this before ever missing payments, or seeking assistance from debt relief professionals. - Rachel:

04 Feb 2017 I would LOVE a copy of this spreadsheet - please!! - Brandi Hatfield:

06 Feb 2017 I too would love a copy of the spreadsheet. - Patricia:

07 Feb 2017 Hi - would love a copy of the excel spreadsheet as well! - KRISSY:

20 Feb 2017 Mike, Could you email me the debt payoff graph :) Thanks